About Canara Bank

History

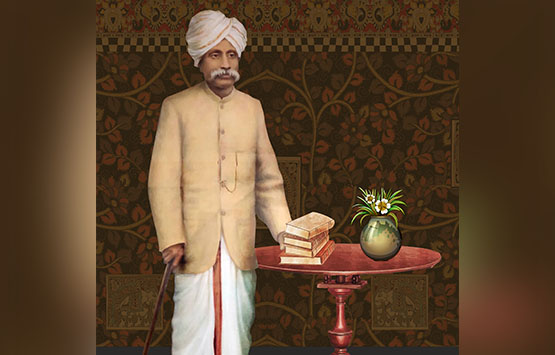

A good bank is not only the financial heart of the community, but also one with an obligation of helping in every possible manner to improve the economic conditions of the common people

Late Sri Ammembal Subbarao Pai

Founding Principles

- To remove Superstition and ignorance.

- To spread education among all to sub-serve the first principle.

- To inculcate the habit of thrift and savings.

- To transform the financial institution not only as the financial heart of the community but the social heart as well.

- To assist the needy.

- To work with sense of service and dedication.

- To develop a concern for fellow human being and sensitivity to the surroundings with a view to make changes/remove hardships and sufferings.

A Brief Profile of the Bank

Widely known for customer centricity, Canara Bank was founded by Shri Ammembal Subba Rao Pai, a great visionary and philanthropist, in July 1906, at Mangalore, then a small port town in Karnataka. The Bank has gone through the various phases of its growth trajectory over hundred years of its existence. Growth of Canara Bank was phenomenal, especially after nationalization in the year 1969, attaining the status of a national level player in terms of geographical reach and clientele segments. Eighties was characterized by business diversification for the Bank. In June 2006, the Bank completed a century of operation in the Indian banking industry.

Vision

To emerge as the Best Bank to Bank with by pursuing industry benchmarks in profitability, operational efficiency, asset quality, risk management and digital innovation.