| 1

|

What is the Objective of the Scheme?

Pradhan Mantri Fasal Bima Yojana (PMFBY) aims at supporting sustainable production in agriculture sector. The major objectives of the scheme are:

- Providing financial support to farmers suffering crop loss/damage arising out of unforeseen events.

- Stabilizing the income of farmers to ensure their continuance in farming.

- Encouraging farmers to adopt innovative and modern agricultural practices.

- Ensuring flow of credit to the agriculture sector which will contribute to food security, crop diversification and enhancing growth and competitiveness of agriculture sector besides protecting farmers from production risks.

|

| 2 |

Who are the Farmers Eligible under this Scheme?

All farmers (both loanee and non-loanee) including sharecroppers and tenant farmers growing the notified crops in notified areas are eligible for coverage. Such farmers are also required to essentially submit Aadhar Number and declaration about the crop sown/ crops intended to be sown. Since, from 2021 the scheme has been made voluntary for all farmers, branches need to keep proper record of farmers’ declarations who have opted out and should encourage them to opt in again.

|

| 3 |

What are the crops covered under this scheme?

All notified crops under Food Crops (Cereals, Millets and Pulses), Oilseeds and Annual Commercial/ Annual Horticultural Crops are covered. In addition, pilots for coverage can be taken for those perennial horticultural/ commercial crops for which standard methodology for yield estimation is available.

|

| 4 |

What are the Premium rates?

| Sl No |

Season |

Crops |

Max Insurance charges Payable

by farmer

|

| 1 |

Kharif |

All Food garins and Oilseed Crops (all cereals, millets, pulses and

oilseed crops)

|

2.00% of Sum Insured or Actuarial rate, whichever is less. |

| 2 |

Rabi |

All Food garins and Oilseed Crops

(all cereals, millets, pulses and oilseed crops))

|

1.50% of Sum Insured or Actuarial rate, whichever is less |

| 3 |

Kharif & Rabi |

Annual Commercial / Annual Horticultural crops

Perrenial Horticultural

/Commercial crops (pilot basis )

|

5.00% of Sum Insured or Actuarial rate, whichever is less |

|

| 5. |

Is Submission of Aadhaar Mandatory by Farmer?

Yes, Aadhaar has been made compulsorily for availing Crop insurance from Kharif

2017 season onwards. Therefore, Aadhar Submission is mandatorily for enrollment under PMFBY scheme.

|

| 6 |

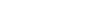

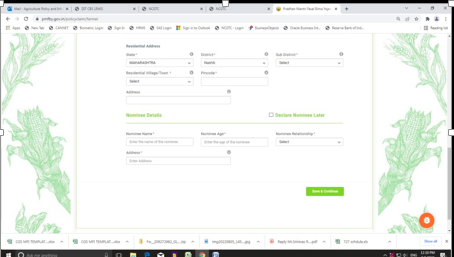

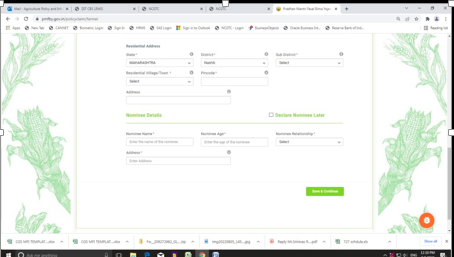

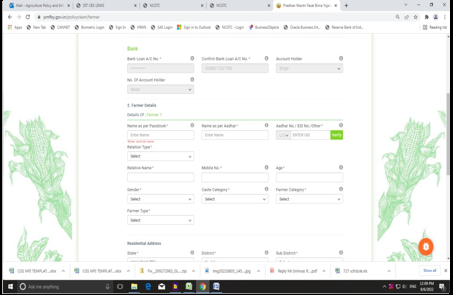

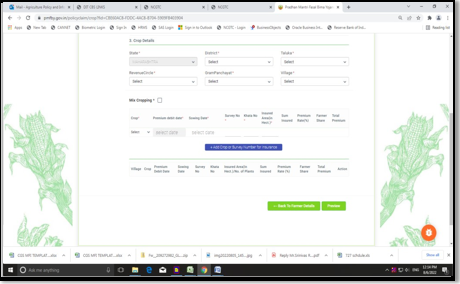

What precautions to be taken while uploading the data on PMFBY portal https://pmfby.gov.in

- Data uploading is a time bound process; hence it should be completed within prescribed time limit.

- Branch should obtain opt out letter from farmers, who are not willing to avail PMFBY insurance coverage and same should be kept on record.

- All the loanee farmers should be covered under PMFBY scheme, if opt out letter not obtained.

-

While uploading the data on PMFBY portal, utmost care should be taken for following fields:

-

Farmer details like, Name, age, Mobile no., category, Aadhar number etc.

-

Farmer details like, Name, age, Mobile no., category, Aadhar number etc.

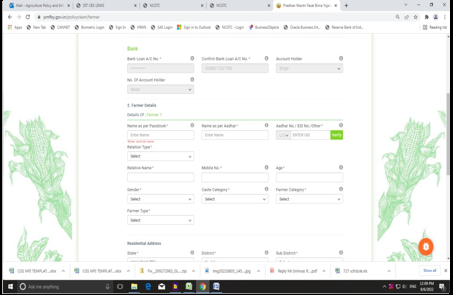

- Crop details and name of the village where the agriculture land is situated.

- Land Survey no./Gat no./ Khatoni no. should be correctly mentioned.

- Notified crop and extent of agriculture land should be entered correctly.

-

If the farmer is having multiple crops on that parcel of land, then branch should enter mixed cropping details and mention proportionate area of that parcel under each crop.

- Branch should ensure that farmer is not deprived of any benefit under the Scheme due to errors/omissions/commissions of the concerned branch, which may in turn attract staff accountability.

|

| 7. |

What is the Procedure for Collection of Application and Premium from Farmers?

- The scheme is optional for all farmers including farmers who have been sanctioned short-term Seasonal Agricultural Operations (SAO) loans/Kisan Credit Card (KCC) for the notified crops from bank (hereinafter referred to as Loanee farmers).

- Existing Loanee farmers who do not want to get covered under the scheme have the option of opting-out from the Scheme by submitting requisite declaration to loan sanctioning bank branch any time during the year but at least seven days prior to the cut-off date for enrolment of farmers for the respective season.

- All those farmers who do not submit the declaration would be essentially covered.

- Issuance of Notification by the State Governments / UTs for the implementation of the Scheme will imply their acceptance of all the provisions, modalities and Operational Guidelines of the Scheme.

- Branches are required to remit the consolidated premium payable to respective ICs mandatorily through the Payment gateway of National Crop Insurance Portal (NCIP) or payment challan generated through NCIP within the stipulated date.

- The remittance of the premium should compulsorily be done within the cut- off date stipulated for the enrolment agencies.

- The cut-off date for enrolment of each notified crop should be based on crop calendars of the districts and normally may not be beyond 15th July for Kharif season and 15th December for Rabi crops.

- All concerned branches compulsorily generate the payment challan and remit the consolidated premium electronically/online through payment gateway on NCIP to the concerned ICs and submit/upload the consolidated requisite proposals/information in prescribed format within the stipulated cut-off dates.

- Ensure that the premium for both loanee and non-loanee farmers are remitted to the concerned ICs and the related data is uploaded on NCIP within the prescribed time limit.

|

| 8. |

How the claim is calculated?

Claims will be calculated based on the loss assessment report submitted by the District Level Joint Committee (DLJC) and/or average yield submitted by concerned State Government.

|

| 9. |

What is the Coverage of risks and what are the exclusions?

Basic Coverage:

Loss occurred on account of non- preventable risks like drought, dry spells, flood, inundation, wide spread pest and disease attack, landslides, natural fire due to lightening, storm, hailstorm and cyclones.

Add on Coverage:

Apart from the mandatory Basic Coverage, the State Governments/UTs, in consultation with the State Level Coordination Committee on Crop Insurance (SLCCCI) may choose any or all of the following add-on covers based on the need of the specific crop/area in their State to cover the following stages of the crop and risks leading to crop loss like:

- Prevented Sowing/Planting/Germination Risk.

- Mid-Season Adversity like prolonged dry spells, severe droughts, floods etc

- Post-Harvest Losses

- Localized Calamities

- Add-on coverage for crop loss due to attack by wild animals

|

| 10. |

What are the other practices which are to be followed for implementation of PMFBY scheme?

- To educate the farmers on the Scheme features, especially the voluntary nature of scheme.

- To guide the farmers on filling up the insurance proposal in the prescribed forms and collecting the required documents, particularly in case of non- loanee farmers.

- To collect Aadhaar Number and Mobile number of all eligible farmers well before the start of enrolment/debit of premium.

- Maintaining the records of the proposal/declaration forms and other relevant

documents and statements for the purpose of scrutiny/ verification by the IC or its authorized representatives and District Level Monitoring Committee (DLMC), if necessary.

- Not to re-enrol the farmers under crop insurance for the same crop if the State/District has notified prevented/failed sowing/germination.

|